When buying a home, many homebuyers tend to search for the best mortgage interest rates available. While some may find that perfect rate, others may opt to take advantage of lender-provided options, such as mortgage points.

Mortgage points are designed to help buyers bring down their interest rates by paying them ahead of time. Sometimes considered “discount points,” mortgage points allow you to pay a larger down payment up front to quell your interest rates throughout the life of your loan.

While that sounds like an excellent option for those searching to put a dent in their future monthly payments, there are a few items to consider.

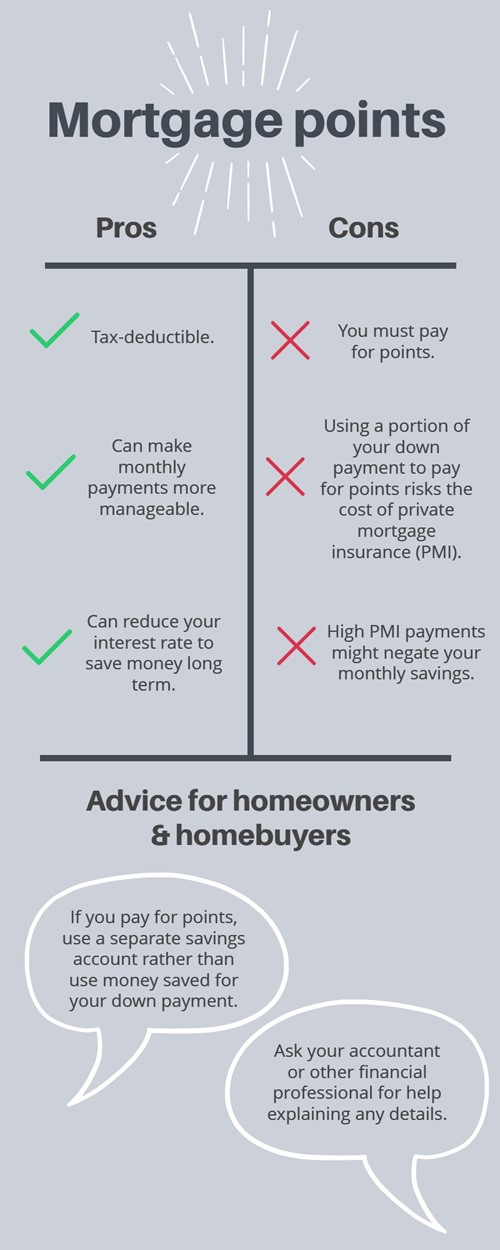

Here are some pros and cons of mortgage points and tips on what to do for your situation:

When delving into the world of mortgage discount points, the immediate hook is your monthly savings in the long term. Mortgage points are exceptional ways to bring your mortgage interest rate into a desirable range, creating more manageable payments on a monthly basis.

Another fantastic feature of mortgage points is they’re tax-deductible. According to the IRS, you can itemize your deductions on a Schedule A, or Form 1040, and only need to meet a few requirements, such as using the “cash method” for tax reporting. You’ll also need to have your primary residence as the loan’s security method.

There are great advantages to discount points. However, there are a few cons that may surface with this kind of lender program. For example, if you plan to pay for mortgage points, try to secure a secondary savings account to make that payment instead of taking it from your down payment.

If you take the funds from your initial down payment, you could end up paying less than the 20% needed to avoid private mortgage insurance, or PMI. Since PMI can increase your monthly payments, you may end up paying more on your monthly mortgage than you’d save, or you could end up pushing out your break-even point, prolonging your larger payments.

There are ways to use mortgage points to your advantage. For starters, make sure you have an in-depth understanding of your current monthly finances, your projected finances and a financial roadmap for the next few years that you can follow easily.

Another fantastic idea is to get in touch with your loan officer or lender. Have them explain your options, what the estimates are for the next few years (or further) and any tips they may have for you. If you find yourself in the beginning stages of your home search, ask your real estate agent for any connections or recommendations to a lender or loan officer.

My experience dates back to 2002 when I obtained my degree in Economics from Kalamazoo College and then immediately went to work as a sales manager for a 72 unit, new home development in Clarkston. I am in my 22nd year of full time residential real estate sales and real estate is my number one passion!

· I earned the "Top Producer" award at Morgan Milzow & Ford Realtors from 2007-2023

· My career accomplishments to date include over 1,000 homes sold and in excess of $315M in closed transactions

· I've been voted an Hour Magazine All-Star 2013-2023, an honor only given to the top 5% of Metro Detroit Real Estate Agents

· I'm a lifelong Clarkston resident & service all of Oakland County, parts of Genesee, Livingston and Macomb Counties, and my area knowledge, professionalism and real estate expertise is unparalleled

· As a top-producing & seasoned Realtor I have a strong support staff that handles all facets of your transaction and thus creates a concierge-like real estate process that is as seamless and hands on as it can be, delivering the service you deserve! “Stress free, worry free” is our mission & mantra

· We offer an unmatched marketing plan with preferred positioning on all major Internet outlets and social media, the best in professional photography, staging, handyman services, top-notch negotiating skills, excellent communication & much more!

· In 2022 I was awarded the Clarkston Chamber of Commerce Independence Women of the Year award for excellence in business and for my community contributions. In 2019 I received the Clarkston Community Businessperson of the Year Award. I’m also proud to have served my community as the Clarkston Area Chamber of Commerce President in 2018 & 2019. I'm a past recipient of the NOCBOR (North Oakland County Board of Realtors) Distinguished Service Award, nominated by my peers

· I consistently contribute to other, local charitable causes that are close to my heart including Tree of Dreams, benefitting Neighbor for Neighbor, SCAMP and Clarkston Schools

· My resume also includes being an investment property owner, landlord, land developer and home flipper. With my experience and expertise plus my valuable connections I can also offer temporary housing to clients ensuring the most harmonious moving transition possible!